A Survive and Thrive program, launched in partnership with Exponential Impact and the City of Colorado Springs

Applications are currently closed.

Preview applications, eligibility and program details below.

OVERVIEW

Exponential Impact (XI), in partnership with the City of Colorado Springs will provide loans up to $50,000, along with mentorship and learning opportunities through the Survive and Thrive program. XI is an engine for entrepreneurial growth in Colorado Springs dedicated to developing the best entrepreneurs humanly possible. XI combines its strong network of leaders, investors, mentors, and business owners to provide impactful tools that pair access to capital with proven capacity building programming.

SUMMARY

The Survive and Thrive Revolving Loan Fund (RLF) is a strategic initiative led by Exponential Impact, in partnership with the City of Colorado Springs, whose core competency is in pairing funding with holistic programming to support sustainable company growth. Survive and Thrive: Accelerate COS is a non-traditional loan process, designed to bridge the financing gap for established businesses ready to scale, creating jobs and strengthening our regional economy.

This program provides up to $50,000 in loan funding to eligible businesses and holistic programming to provide participants with both financial resources and community support. If awarded funds, business owners are expected to participate in an 8-week program. Businesses participating in the program will benefit from having access to mentorship and networking opportunities, as well as in-person skill-building workshops.

In order to receive a loan, owners must participate in the XI Survive and Thrive program, this participation will come before all funds are distributed and is intended to build capacity and support leadership development. Programming includes:

WHO IS THis loan FOR?

-

El-Paso County Based Small Business Entities, Non-Profits, and Sole Proprietors that fall into one or more of the following categories:

Seeking growth opportunities

Hire, train, or retain employees

Redefined business model or recapitalized

Barriers to accessing traditional capital or financing

Early or mid-stage stage businesses looking to scale

No established credit history

Temporary financial strain emerging from external circumstances

Prioritized businesses:

Show growing sales with stable or improving margins

Are ready to hire, train, or retain employees

Have clear expansion plan with realistic projections

Possess established customer base with recurring revenue potential

Can articulate clear ROI from loan funds

-

Primary business activities are conducted in El Paso County with majority of employees working in El Paso County

Employ no more than 50 full-time employees

Earns less than $2,000,000 in annual gross revenue

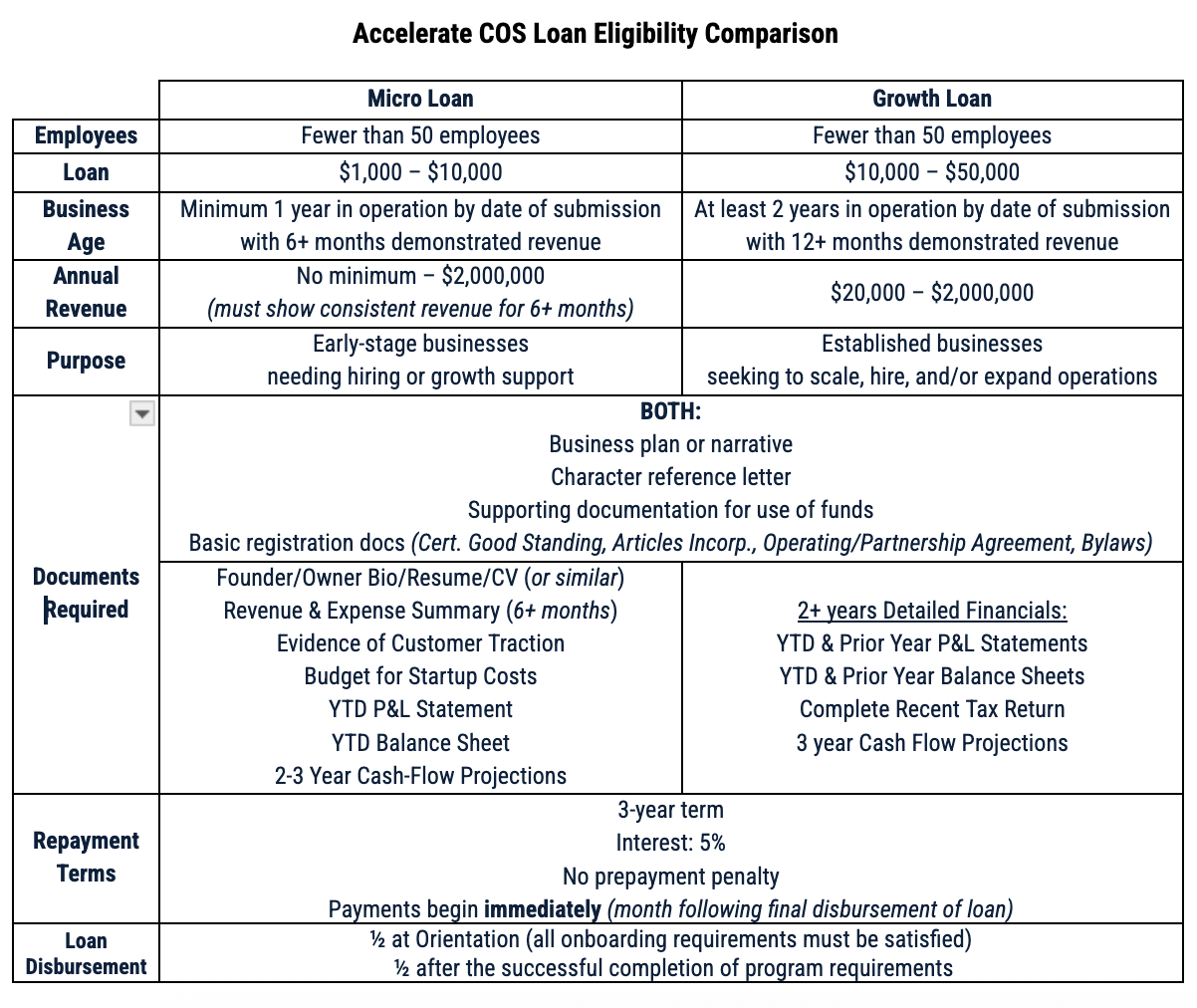

Micro Loan: Early-stage businesses eligible for a micro loan must also meet the following minimum requirements:

At least 1 year in operation and 6+ months of documented positive cash flow

Generating consistent revenue with potential for profitability and growthClear growth plan with measurable outcomes

Evidence of market demand and customer traction

Growth Loan: More established businesses eligible for loans between $10,000 and $50,000 must meet these additional criteria:

Be in operation for at least 2 years by the application deadline with demonstrated profitability for at least 12 consecutive months

Be generating consistent revenue (over $20,000 annually) with potential for profitability and growth

Provide comprehensive financial statements showing stability and profitability

-

Payday loan businesses

Pawn shops

Adult entertainment

Passive real estate investments

Home-based businesses operating without appropriate zoning and/or permits

Marijuana related businesses

-

Loan applications will be open for approximately one month on a bi-annual basis, with cohort programming being held after loans are awarded. The goal is to provide a permanent financial tool while supporting the needs of applicants to support economic growth and locally owned businesses. As such, the fund will be divided into two programs, Micro Loans and Growth Loans. The no-collateral loans offer competitive low rates, 3-year terms, and no prepayment penalty.

Accelerate COS is a loan program, not a grant program. Approved loans will have a term, interest rates, and payment schedule. Submitted applications do not guarantee loan approval. Loan applications will open two times per year. Loan sizes are subject to change based on fund size and discretion of loan committee. Interest rates are subject to change in accordance with market changes, to be approved by the Executive Committee.

LOAN DETAILS AND TERMS

To qualify for a loan, businesses must be in operation at least one year on date of submission and demonstrate a minimum of 6 months of revenue generation. More established businesses, in operation at least two years, may qualify for a Growth loan. Businesses with a current Survive and Thrive loan balance are not eligible to reapply until the balance is repaid. *Loan amounts are subject to change based on fund size and discretion of loan committee

PLEASE NOTE: A successful application ultimately focuses on two essential pillars: (1) how well do you share your business's story, and (2) how detailed is the justification provided for the requested loan amount & how it will be utilized. Clear, comprehensive responses are crucial for approval - vague or incomplete information could result in denial.

Micro Loan Terms

Loan Amount: $1,000 - $10,000

Loan Term: 3 years - No prepayment penalty

Interest Rate

5% interest

Payments begin the month following final loan disbursement

GROWTH Loan Terms

Loan Amount: $10,000 - $50,000

Loan Term: 3 years - No prepayment penalty

Interest Rate

5% interest

Payments begin the month following final loan disbursement

*Interest rates subject to change in accordance with market changes and the Executive Committee.

ANNUAL Program TIMELINE

*SCHEDULE OR TOPICS SUBJECT TO CHANGE

APPLICATION QUESTIONS

*Please have the following information available when you begin the application. We suggest reviewing the full application and prepare your narrative statements on a separate document to be copy/pasted into the application when you’re ready to complete. See below for resources and templates.

-

Business Legal Name and DBA (if applicable)

Contact Name, Phone Number, and Email

Owner Demographics

Business Phone Number, Operating Address, Mailing Address, Website

Location of Business

Business EIN or SSN

NAICS Code

Starting Month/Year of Business

Description of Business

Legal Structure

Industry

Business Ownership List

Names of all corporate officers

Number of jobs at time of application- FT and PT

Average Monthly Payroll Expenses & Hourly Wages

Number of new jobs to be created as a result of this loan

Areas of business or business knowledge you would like to improve

Description of current team, mentors, advisors, etc.

Loan Amount Requested

How will Funds be Utilized?

How will these funds support the long-term viability of your organization?

How did you hear about us?

-

A successful application ultimately focuses on two essential pillars: (1) how well do you share your business's story, and (2) how detailed is the justification provided for the requested loan amount & how it will be utilized. Clear, comprehensive responses are crucial for approval - vague or incomplete information could result in denial.

-

Pay off non-business debt, such as personal credit cards for purchases not associated with the business

Personal purchases or expenses such as buying a new family car or making repairs to a participant’s home

Direct financing to political activities or paying off taxes and fines

Purchase of personal items

Businesses that do not intend to hire employees, retain staff, expand operations, or reinvest in growth

Support of other businesses in which the participant may have an interest

Relocation of a business

-

In the application process, you will be asked for a narrative (written explanation) about the potential impact of these funds on your business and how you plan to use the funds. This narrative is a key part of the application, often carrying equal weight to the financial data. Your narrative should vividly portray your vision, strategy, and commitment to leveraging the funds effectively for business growth. To make your application stand out, here are some ideas to help writing the narrative portions:

We recommend providing specific, measurable, and realistic details about how the funds will be used.

Use this narrative as a platform to demonstrate your passion and dedication to the success of your business, and impact in our community.

Share stories that convey your unique journey and the significance this program will have in your entrepreneurial path.

Highlight the community benefits your business brings, as your success reflects positively on the economic growth of Colorado Springs.

In essence, your narrative is your canvas; paint a clear, compelling picture of your future and the role the Survive & Thrive Program and Loan will play in achieving it. The documents listed below help to demonstrate the viability and legitimacy of the business.

-

All Applicants

Character Reference Letter(s)/Letter(s) of Recommendation

Business Plan - or strong narrative within application describing: what you do, who you serve, and what your plan for growth is

Supporting document for the intended use of funds

Articles of Incorporation

Certificate of Good Standing from the State of Colorado

If Corporation: Bylaws

If Partnership: copy of Partnership Agreement

If LLC: Operating Agreement

Growth Loan

YTD & Prior Year P&L Statements

YTD & Prior Year Balance Sheets

Complete Recent Tax Return

3 year Cash Flow Projections

Micro Loan

Founder/Owner Resume/CV (or similar)

Revenue & Expense Summary (6+ months)

Budget for Startup Costs

Evidence of Customer Traction

2-3 year Cash-Flow Projections

YTD P&L Statement

YTD Balance Sheet

If Available: Recent Tax Return and YTD Cash Flow Statement

Know How Your Application Will Be Evaluated

Before you apply, review the rubrics our committee uses to score applications. Understanding these criteria will help you prepare a stronger application.

Micro-Loan Evaluation Rubric ($1,000-$10,000)

Growth-Loan Evaluation Rubric ($10,000-$50,000)

TEMPLATES & EXAMPLES

Balance Sheet Template

CASH FLOW TEMPLATE

PROFIT AND LOSS TEMPLATE

APPLICANT EXAMPLES

APPLICATION AND REVIEW PROCESS

Applications will be open for one month, two times per year. A review committee, consisting of volunteer community leaders, City of Colorado Springs Professionals, and XI staff, will meet to review all submitted applications, with the goal of making announcements within three weeks of submission deadline, and at least two weeks prior to start of programming. Programming will take place for 8-weeks, following funding announcements. Participants will receive their full loan following the successful completion of the program.

Know How Your Application Will Be Evaluated

Before you apply, review the rubrics our committee uses to score applications. Understanding these criteria will help you prepare a stronger application.

Micro-Loan Evaluation Rubric ($1,000-$10,000)

Growth-Loan Evaluation Rubric ($10,000-$50,000)